Effective market surveillance and control of movement of liquid fuels can be a complicated task, especially in terms of quality, quantity and collection of excise duties. It seems that most countries have found a somewhat cumbersome and inefficient way to address this challenge.

Fortunately, rapid development of technology is creating opportunities every day. And this is also the case with blockchain technology, or distributed ledger technology in a wider sense, which can be employed to manage these tasks with relative ease.

The following idea was developed as a whole, specifically under Polish regulatory requirements and during bilateral meetings with competent authorities in Poland. It reflects relevant industry actors such as refineries, petrochemical companies, petrol and liquid fuel transmission operators, companies engaging in the construction of transmission pipelines and supporting structures, and finally petrol stations. However, it can be easily adapted for any country.

In order to satisfy all stakeholders, we must first define some critical roles.

The Issuer – a competent authority that is eligible to issue new utility tokens that represents strict units of liquid fuel, for example one litre of petrol. This authority can be a central bank or a company of strategic importance for national energy security. Token type, capacity and rules of issuance must be defined under private blockchain protocol in advance.

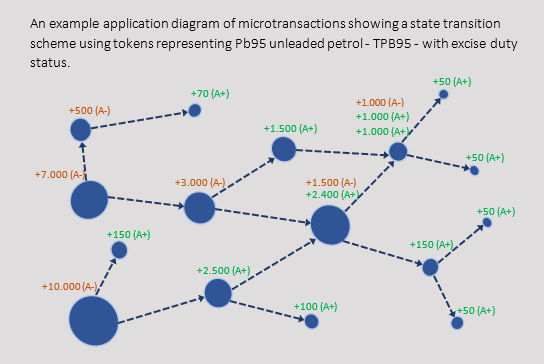

Relay Entity – a stakeholder eligible to transfer liquid fuel to other entity, for example refinery, operator, petrol station, infrastructure owner. Relay entities utilise microtransactions and multi-signature features to confirm (separately) the releases or collections of the definite amount of fuel. To handle quantity discrepancy and even quality issues (such as share of bio-components) we employ relevant smart contract or chain code (via ISO standards). Together with a temperature sensor installed on the tanker we can reduce the risks associated with transporting liquid fuels.

Block Producer – a special role responsible for validating transactions and voting for the new blocks. Chain producers take part in wide consensus group. Both the issuers and relay entities can act as block producers.

There are three types of nodes required for the network architecture to operate in an efficient and transparent way. full nodes are responsible for storing full blockchain with full excise mark auditing path; light nodes are for fast routing and simplified transaction inputs and outputs verification; and mobile nodes are used for movement initiating and confirming, and excise-mark stamping for tax purposes.

Although it is possible for every network participant to act as a full node, it is required for security reasons to impose full node type on the issuers and main relay entities such as refineries, logistics operators and infrastructure operators. Other participants will follow their needs according to the resources available. The network shall use the energy-efficient Proof-of-Authority (PoA) method of consensus and provide the issuer with voting rights that guarantee majority for producing blocks and assembling final chain.

How does this work in practice?

By Rafal Chrabol, CEO, Smart Faktor, PCTA member

.png)

The EACT has been advocating for a digital identity for Corporates for many years now. We believe that, Corporates, like individuals, must have a single identity which help them to identify itself and identify third parties as well in this digital era.

Read.png)

The Supply Chain Due Diligence Act (LkSG) creates the legal framework to improve the protection of the environment and human rights along German supply chains. GACT spoke to Dr. Julia Sitter (White & Case LLP) about the relevance and need for action by treasury departments.

Read.png)

The Capital Market Union, which was one of the main objectives of the Vander Leyen Commission, is back in the limelight, and is likely to become a priority for the next Commission next summer.

Read.png)

General insights into the common priorities of corporate treasurers that will still be relevant in 2024.

Read.png)

François Masquelier lists some comprehensive steps to best assess counterparty risks.

Read